change in operating working capital formula

Short-term debt actually works in a companys favor when calculating the OWC. 247 294 Tax Assets.

Working Capital The Gap.

. 09222012 Hi everyone - Im trying to recreate a model from an equity research report but I cant seem to figure out how the author calculated the change in working capital. Working capital is the amount of available capital that a company can readily use for day-to-day operations. So the Net Working Capital of Jack and Co is 80000.

Since the change in working capital is positive you add it back to Free Cash Flow. This is because a large amount of debt actually reduces the amount of. Calculate the change in working capital.

Non-cash working capital 1904 335 - 1067 - 702 470 million. Determine whether the cash flow will increase or decrease based on the needs of the business. It measures a companys.

Net Operating Working Capital Cash Accounts Receivable Inventories Accounts Payable. This metric is much more tied to cash flows than the net working capital calculation is because NWC includes all current assets and current liabilities. Changes in working capital equals a change in current assets minus a change in current liabities.

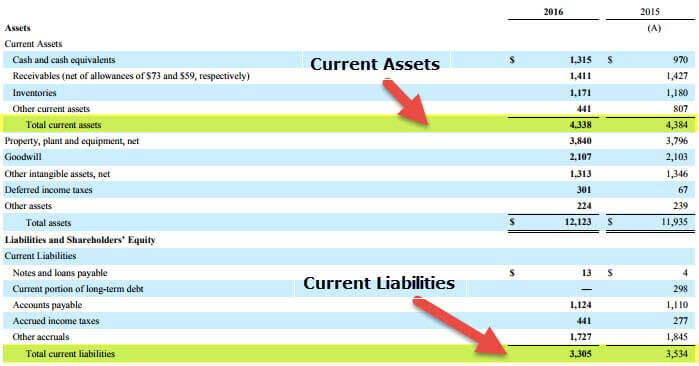

Operating Working Capital OWC Operating Current Assets Operating Current Liabilities Key Learning Points Working capital is a measure of liquidity and calculated as current assets less current liabilities. Net Operating Working Capital Current Operating Assets Current Operating Liabilities In many cases the following formula can be used to calculate NOWC. Working capital is calculated as.

Whilst cash is a Current Asset the decision to. Current Assets Current Liabilities Working Capital Ratio. Working Capital Ratio Formula.

Operating Working Capital OWC Operating Current Assets Operating Current Liabilities Key Learning Points Working capital is a measure of liquidity and calculated as current assets less current liabilities. This means this amount is sufficient to pay off the current liabilities. The formula for calculating net operating working capital is.

OWC Assets - Cash and Securities - Liabilities - Non-interest liabilities. Working capital is a measure of both a companys efficiency and its short-term financial health. Cash is excluded from Operating Working Capital as it is considered as a Non-Operating Asset.

The simple operating cash flow formula is. Change in Working capital does mean actual change in value year over year ie. Changes in working capital equals a change in current assets minus a change in current liabities.

The goal is to. It tells investors how much cash the company is investing in the working capital of the business. The accounts are as follows 2013 2014.

This is done simply by dividing total current assets by total current liabilities to get a ratio such as 21 twice as much in assets or 11 equal assets and liabilities. Add or subtract the amount. The simple formula above can be built on to include many different items that are added back to net income such as depreciation and amortization as well as an increase in accounts receivable inventory and accounts payable.

Working Capital Ratio Formula. Working capital refers to a specific subset of balance sheet items. Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital.

It means the change in current assets minus the change in current liabilities. Operating Working Capital Accounts Receivable Inventory Work in Progress - Accounts Payable. Working capital Current assets current liabilities.

Lets look at an example. If interest is not charged on a. It doesnt equal an actual change from year to year.

Working Capital Question - Trying to create a model Originally Posted. Change in Net Working Capital NWC Example Calculation Current Operating Assets 50mm AR 25mm Inventory 75mm Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm Net Working Capital NWC 75mm 60mm 15mm. The non-cash working capital for the Gap in January 2001 can be estimated.

Operating working capital is the measure of all long term assets versus all long term liabilities. Net Working Capital Total Current Assets Total Current Liabilities. A key part of financial modeling involves forecasting the balance sheet.

In Table 1010 we report on the non-cash working capital at the end of the previous year and the total revenues in each year. Working Capital Current Assets Current Liabilities. What is Financial Modeling Financial modeling is performed in Excel to forecast a.

Net Working Capital is Calculated using Formula. The formula for calculating operating working capital is. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off.

The concept of operating working capital is a beneficial measuring stick for newer businesses which often accrue large amounts of short-term debt in an attempt to get the business off the ground. Net Working Capital Formula Current Assets Current Liabilities Cash and Cash Equivalents Trade Accounts Receivable Inventories Debtors Creditors Short-Term Loans 135000 55000 80000. The definition of working capital shown below is simple.

Because of this NOWC is often used to calculate free cash flow. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling. Operating Cash Flow Net Income All Non-Cash Expenses Net Increase in Working Capital.

Thats why the formula is written as - change in working capital. Alternatively you can calculate a working capital ratio. Cash Accounts Receivable Inventory Accounts Payable Accrued Expenses.

Cash Accounts Receivable Inventory Accounts Payable Accrued Expenses This calculation is tied much more closely to current cash flows than the equation to determine plain net operating capital because net working capital includes all of a companys current assets and liabilities.

Working Capital Formula And Calculation Exercise Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

Working Capital Formula And Calculation Exercise Excel Template

Net Working Capital Definition Formula How To Calculate

Net Working Capital Template Download Free Excel Template

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Formula And Calculation Exercise Excel Template

Net Working Capital Formula Calculator Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Formula And Calculation Exercise Excel Template

Working Capital Formula Youtube

Changes In Net Working Capital All You Need To Know

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Formula And Calculation Exercise Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Fcf Formula Formula For Free Cash Flow Examples And Guide

Working Capital What It Is And How To Calculate It Efficy

How To Calculate Working Capital Turnover Ratio Flow Capital

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)